Are you a freelancer feeling overwhelmed by the complexities of calculating your taxable income? Are you aware of your gross income and taxable income? Don't stress! With the right tools and knowledge, calculating income taxes can be a breeze. Join us as we demystify the process of what is the tax calculation formula in Excel and equip you with the knowledge you need to confidently calculate and file your taxes like a pro.

Wouldn't it be great if I could tell you there was a secret weapon to make tax season even easier? Enter: Excel! This trusty tool is about to become your new best friend when it comes to calculating your income tax. Learn the formula for income tax calculation in Excel. No more relying on outdated software or struggling with confusing formulas. With Excel, you'll have all the power at your fingertips to easily calculate your tax bill and make any necessary adjustments on the fly. Plus, with its user-friendly interface, even the most math-phobic among us can become tax calculation pro.

From job-seekers to employees and freelancers, everyone would benefit from knowing these Excel formulas to calculate your Income taxes. Meanwhile, did you know that QuickBooks can help you sort out your finances easily? To master the QuickBooks hacks(this is applicable to users outside India, QuickBooks are likely to be discontinued in India), you can reach out to the keySkillset QuickBooks course.

Think of us as your personal Excel tax coach, ready to guide you through the process.

Now, here is the Budget 2023 New Income Tax Regime to start off with. You can refer to the tax rates here to see which is applicable for you.

Income tax calculation in Excel

Are you ready to simplify your tax calculation process with Excel? Then buckle up, because we've got some exciting methods to share with you!

With Excel, you can easily keep track of all your income, expenses, and expenditure in one convenient worksheet. This means that calculating your income tax is just a few clicks away.

Excel also provides some in-built functions that you can use to calculate your income tax with ease. These methods include:

- The IF function

By using Excel to calculate your income tax, you're effectively creating a financial model of your tax liability. This model can help you understand the impact of changes in your income, deductions, and tax rates, and make informed decisions about your finances. Whether you're a freelancer, entrepreneur, or employee, join us as we explore the connection between financial modeling and calculating income tax in Excel.

Here, there is a blog link on how to use financial statements in financial modeling.

We'll walk you through each method in detail, so you can choose the one that works best for you. So, let's get started and make tax season a thing of the past!

Calculate the income tax and taxable income

First, let’s start off by differentiating gross income and taxable income. Gross income refers to the total amount of money earned from all sources, including salary, rental income, interest from fixed deposits, and others. Taxable income, on the other hand, is the amount of income that is subject to taxation, calculated by subtracting exemptions and deductions from the gross income.

Here's how to calculate taxable income in an Excel sheet:

- Create a column for gross income, and enter the amount of money earned from all sources in this column.

- Create a separate column for exemptions, and enter any exemptions applicable to your income, such as personal exemptions or standard deductions.

- Create a separate column for deductions, and enter any deductions applicable to your income, such as home mortgage interest, charitable donations, or business expenses.

- In a separate cell, subtract the exemptions from the gross income.

- In another separate cell, subtract the deductions from the result obtained in step 4.

- The result in step 5 is your taxable income, which is the amount of money subject to taxation.

For example:

Now, let us calculate the income tax on the taxable income.

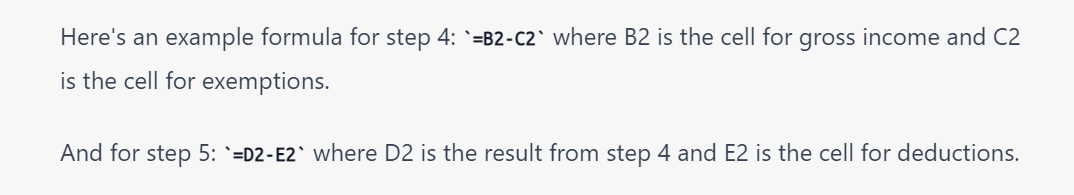

Step 1: This is an example of an Excel worksheet containing someone’s income details. Here

In A2 cell you have the Gross income written and the amount given in B2 cell. Deduction and exemption amounts are also placed in the corresponding cells.

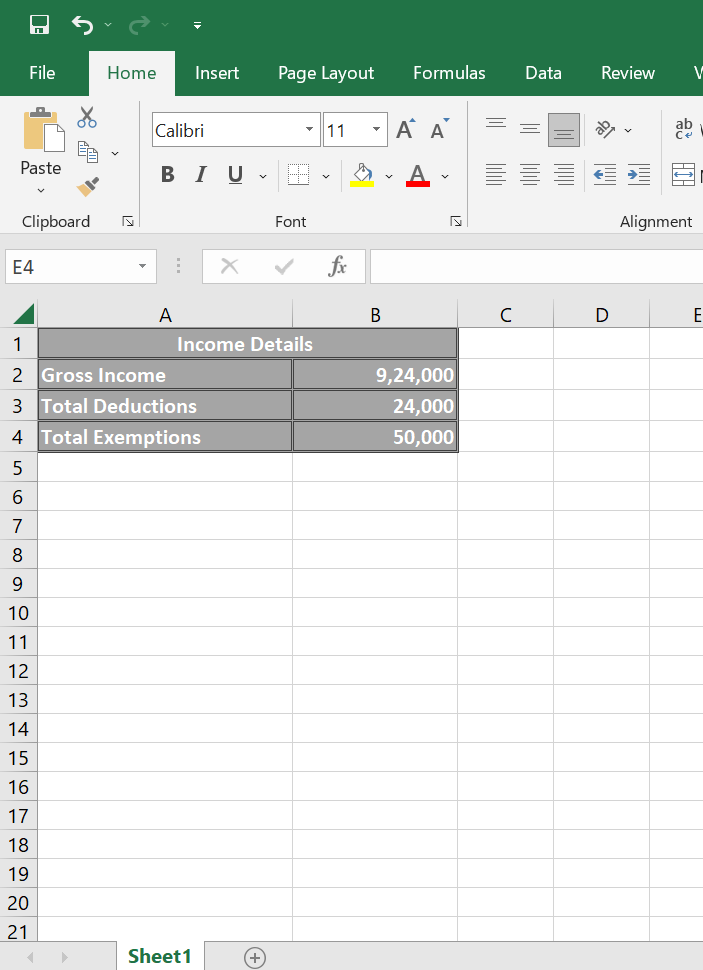

Step 2 : Now, to calculate the taxable income and tax, create two rows: one for the taxable value and another for the tax.

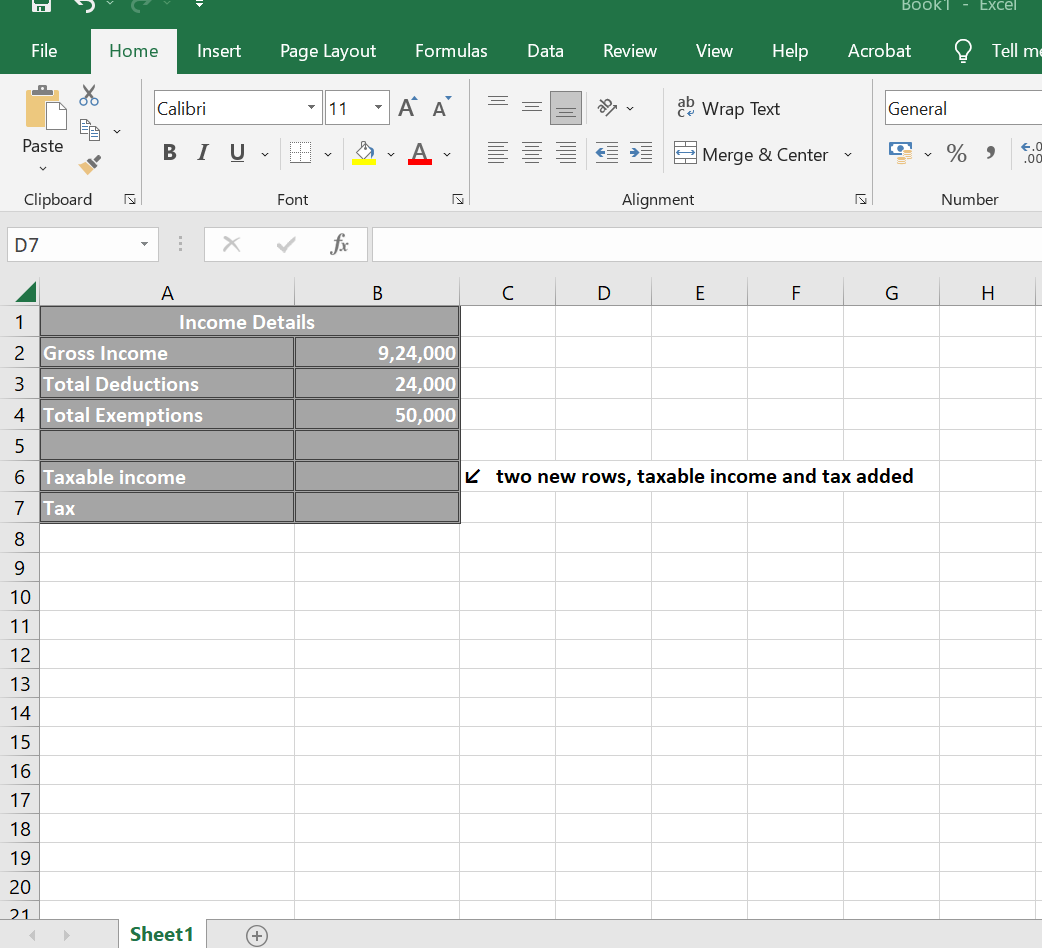

Step 3: Now, choose the cell where you want to get the calculated result and subtract the expenses(exemptions + deductions) from the gross income. You can write the formula =B2-B3-B4 inside the formula bar and press the Enter key.

Step 4: Taxable income is now extracted from gross income, which is Rs, 8,50,000

(Taxable income is on which we apply the tax).

.

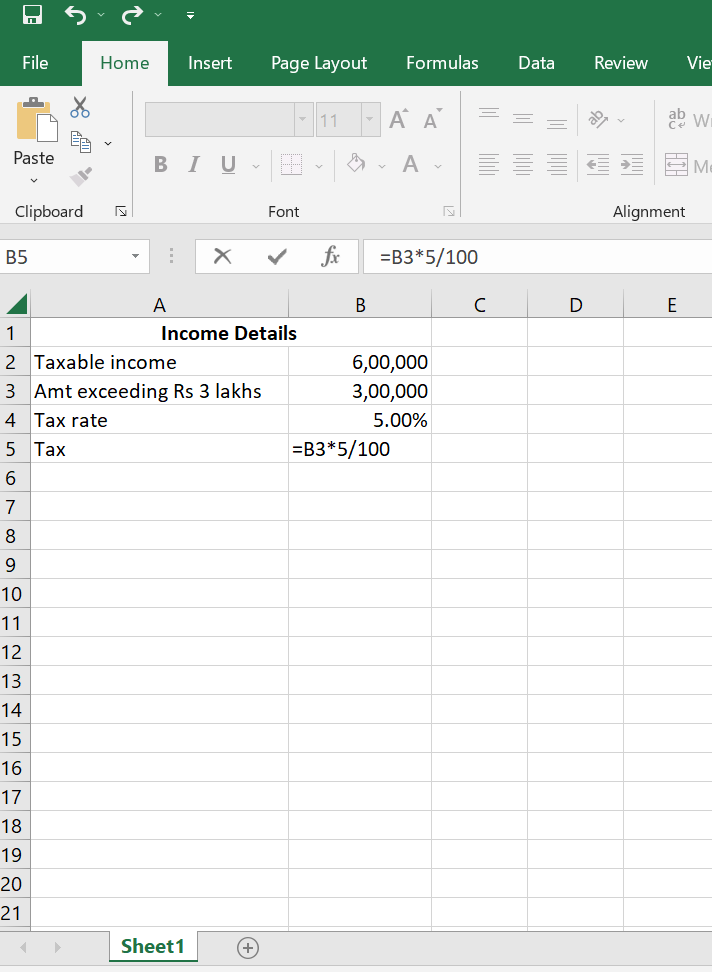

Step 5: We know that up to Rs 3 lakhs, the tax rate is nil. And for up to Rs 6 lakhs, the income tax rate is 5%. So here let us first see the income tax amount for rates up to 6 lakhs. Here, you can apply the =B3*5/100 formula in the cell B5. Here, B3 is the cell reference containing the value for which you want to calculate 5%. The formula multiplies that value by 5/100, which is equivalent to 5%, to get the result.

Also, the result for the formula applied on the amount is given here:

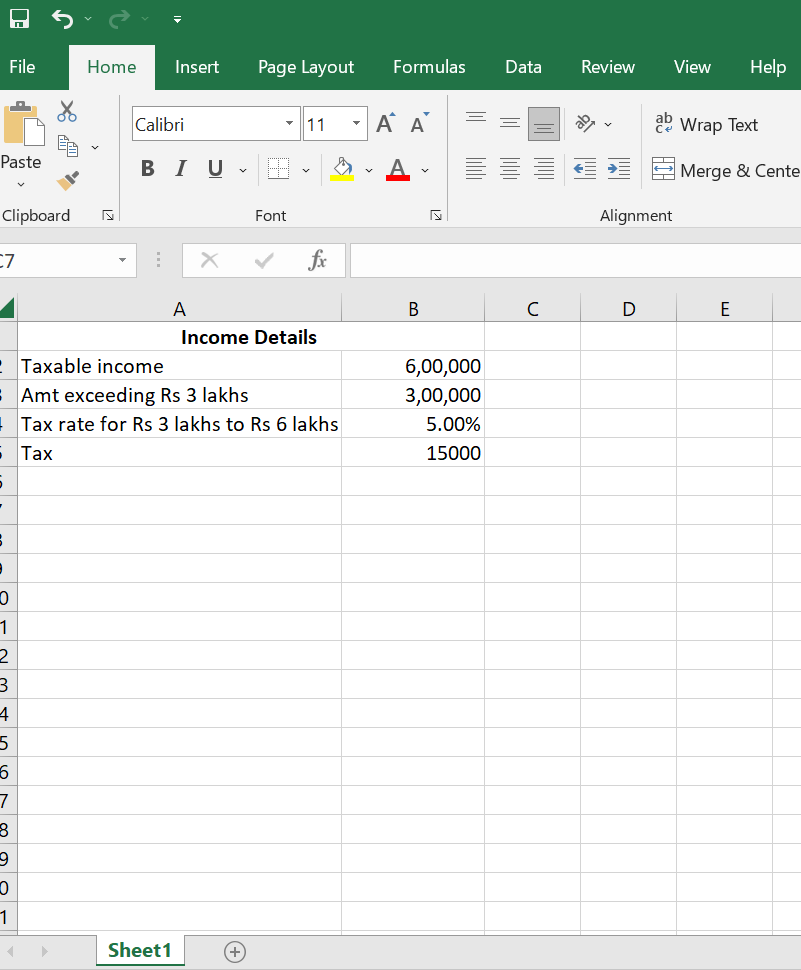

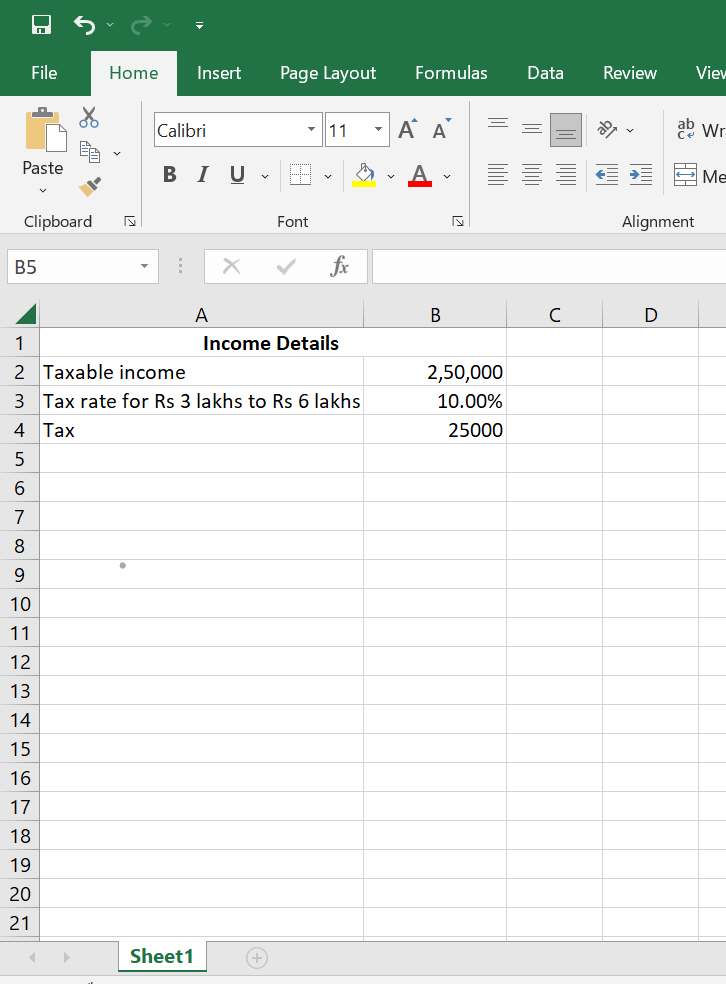

Step 6: Now, calculate the tax on the amount from Rs 6 lakhs to Rs 8 lakhs 50 thousand. We know that up to Rs 6 lakhs the tax calculated in Rs 15 thousand. Now, if we deduct that Rs 6 lakhs from the Rs 8 lakhs 50 thousand, the amount left will be Rs 2 lakhs 50 thousand.

We know very well that as per the new tax regime of Budget 2023, the tax applicable for between Rs. 6,00,000 to Rs. 900,000 is Rs 15,000 + 10% on income more than Rs 6,00,000. And here we will see how to apply that 10% to the amount more than Rs 6 lakhs here which is Rs 2 lakhs 50 thousand.

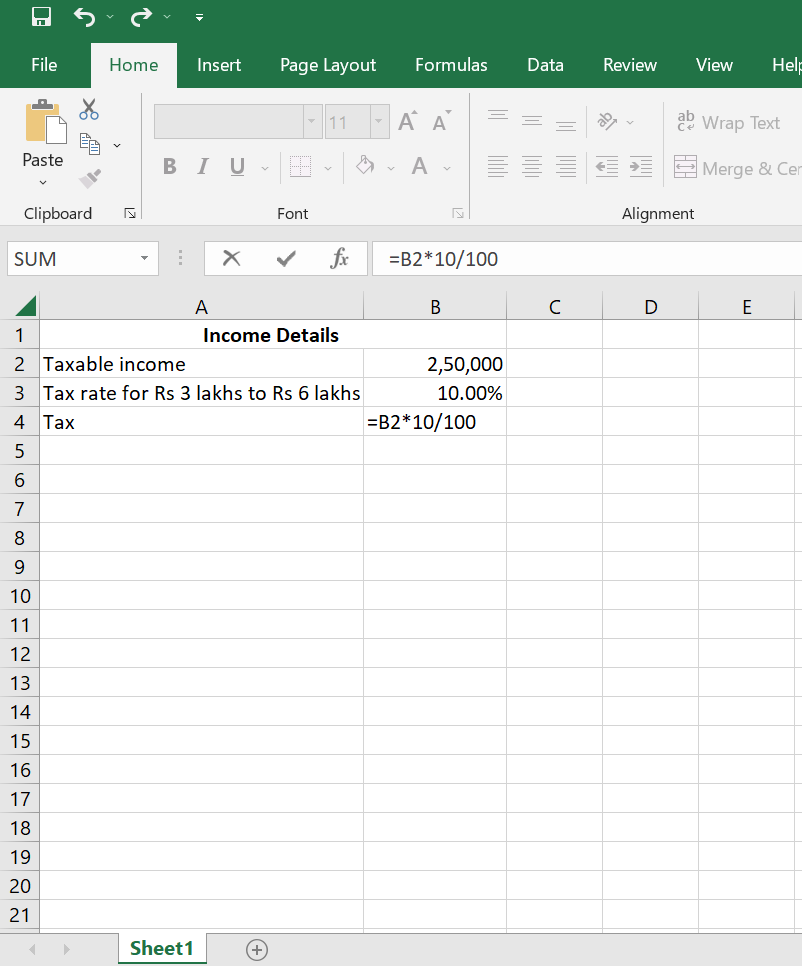

Step 7: You can apply the =B2*10/100 formula in the cell B4. Here, B2 is the cell reference containing the value for which you want to calculate 10%. The formula multiplies that value by 10/100, which is equivalent to 10%, to get the result.

Step 8: Once you press enter you can find the income tax value calculated on the taxable income. Here, you will find the returned value is Rs, 25,000.

So, now we can see that for the Rs 8 lakhs 50 thousand taxable income, the tax applicable will be Rs 15,000 + 10% on income more than Rs 6,00,000= 15000+ 25000= 40,000. So the tax amount here is Rs 40,000.

How to calculate the income tax in Excel using IF Formula?

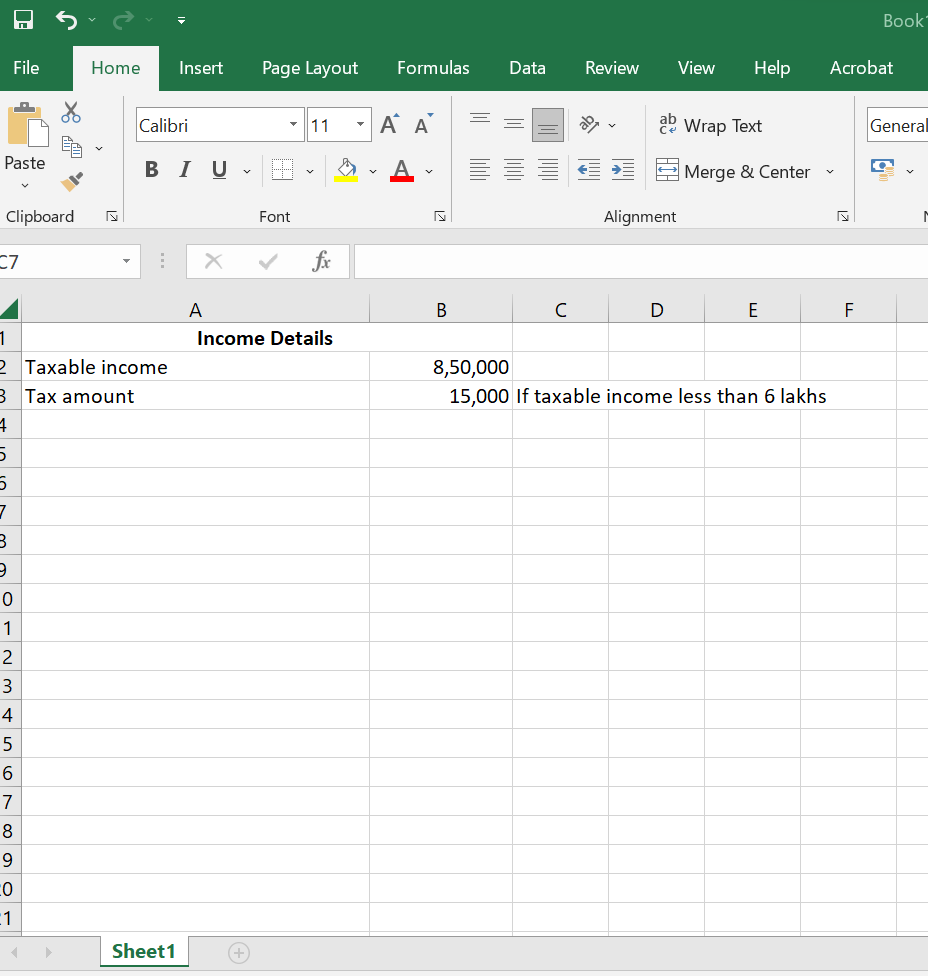

See how you can calculate the income tax using the IF function on the Excel. Here, the formula for income tax may be lengthy, but you can get faster results. Find here the example of calculating income tax, using the IF function in Microsoft Excel(for a tax slab of 6 lakhs to 9 lakhs). Consider the amount to be Rs 8 lakhs 50 thousand with a tax rate of Rs 15,000 + 10% on income more than Rs 6,00,000 applicable.

Suppose you have an income of 8,50,000 INR and a tax slab rate of Rs 15,000 + 10% on income more than Rs 6,00,000.

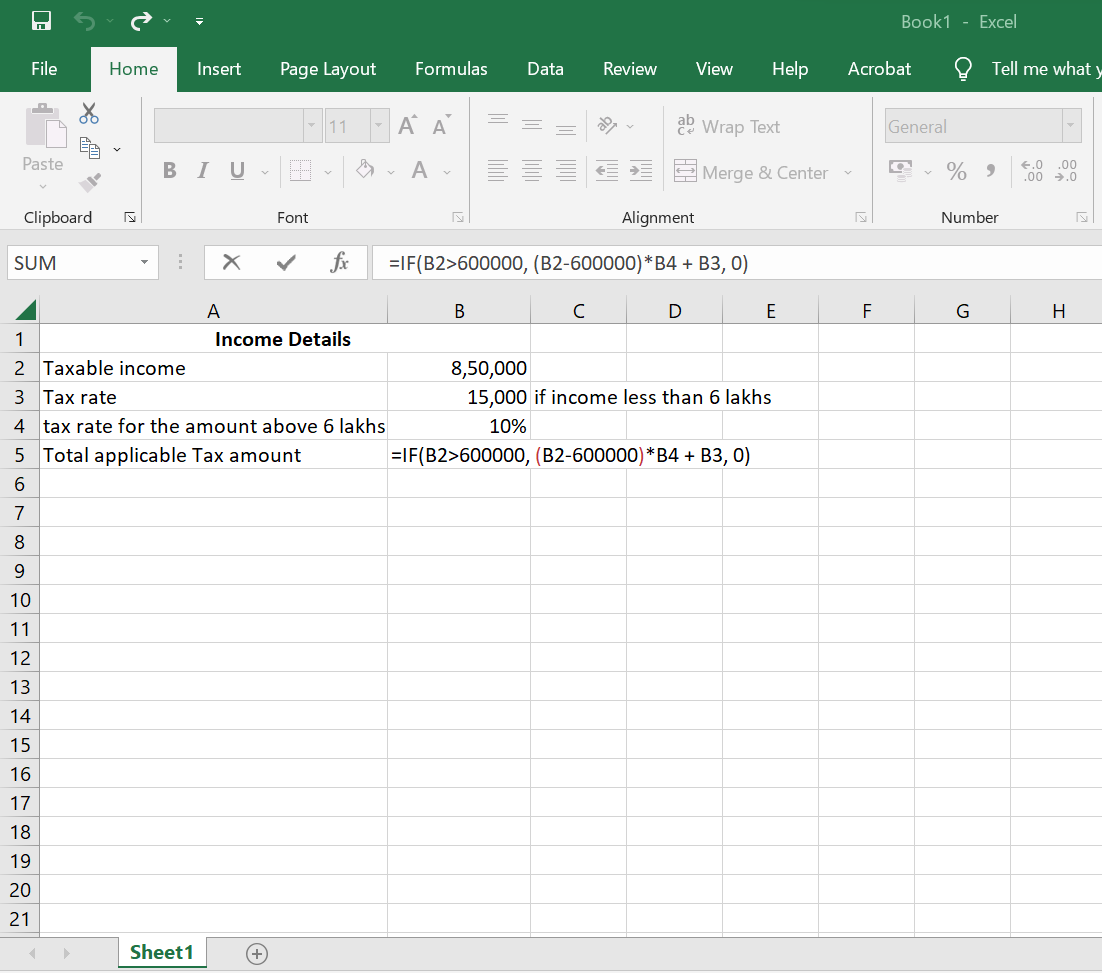

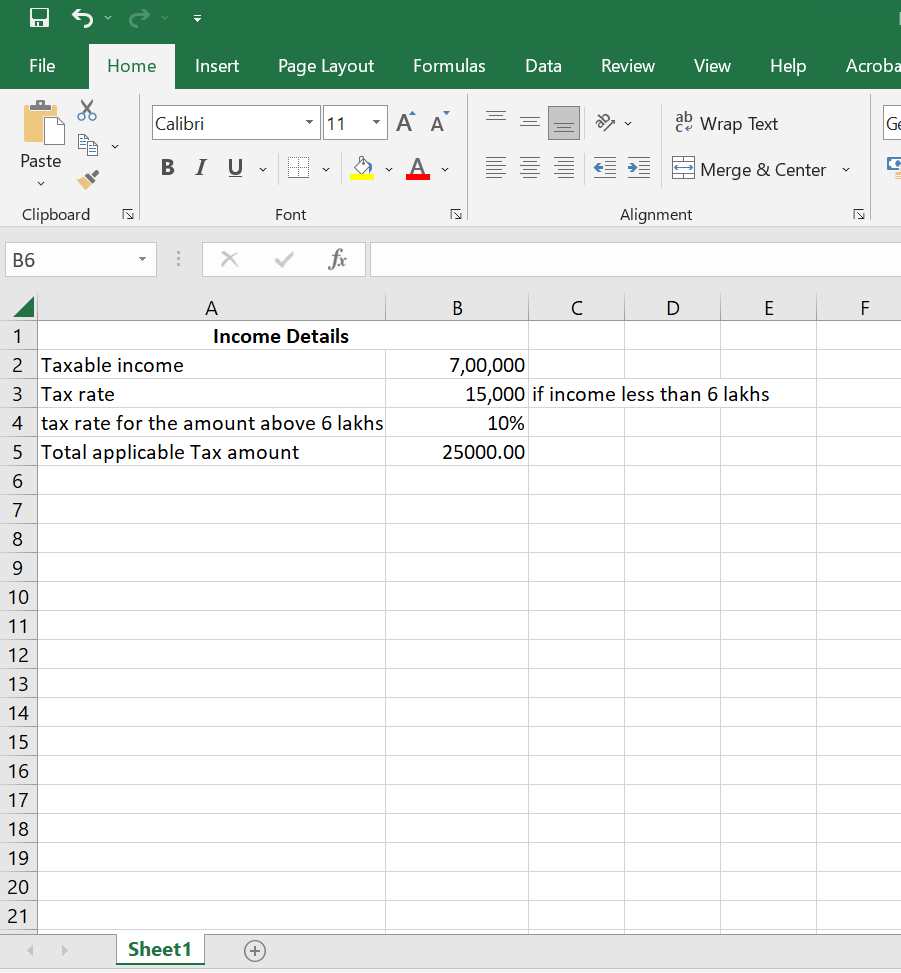

Step 1: Open a new Excel spreadsheet. In cell A2, type "Taxable Income". In cell B2, type Rs 8,50,000.

Step 2: In cell A3 type "Tax rate". In cell B3, type Rs 15,000 (mark it as if income less than 6 lakhs)

Step 3: In cell A4, type "Tax rate for amount above 6 lakhs" and in cell B4 add 10%.

%252520.png)

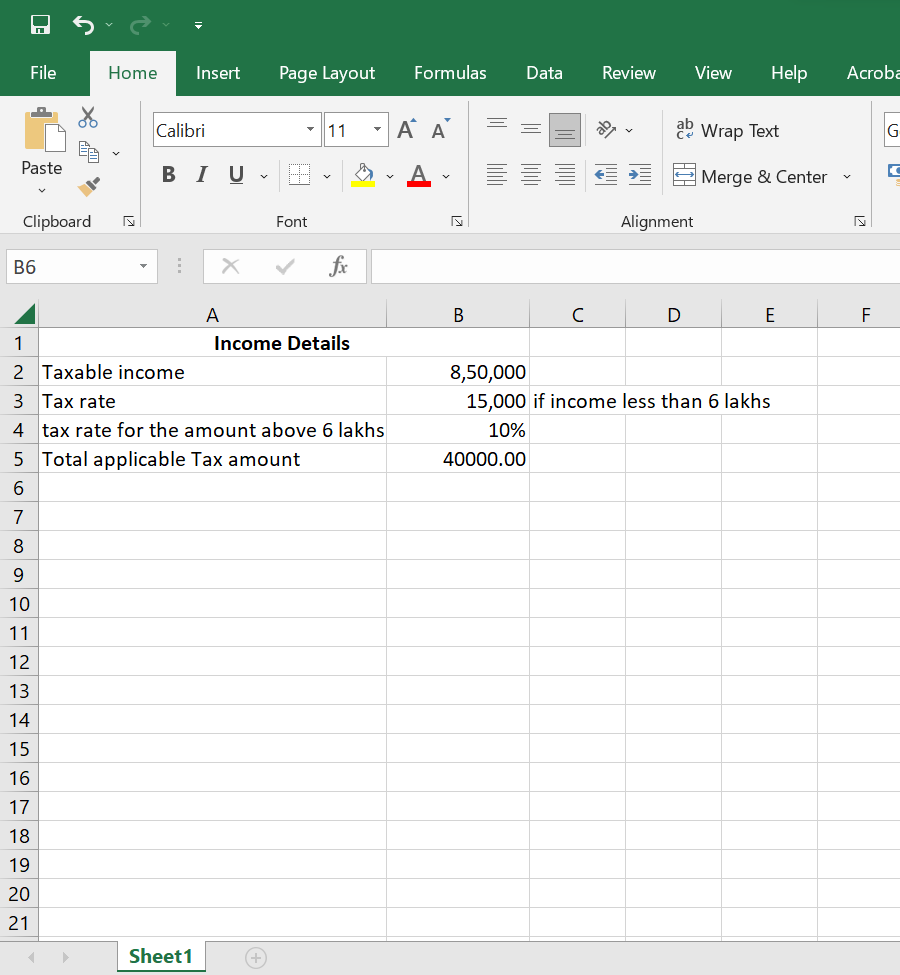

Step 4: In cell B5, type the following formula: =IF(B2>600000, (B2-600000)*B4 + B3, 0)

Step 5: Press enter to see the calculated tax amount in cell B5. In this case, the calculated tax would be (850000-600000) x10% + 15000= 250000 x 10/100 +15000= 25000+ 15000 = 40000 INR.

Step 6: To see the impact of a change in your income, you can adjust the value in applicable cells and see the corresponding tax amount in cell B5.

If value is 7 lakhs taxable income.

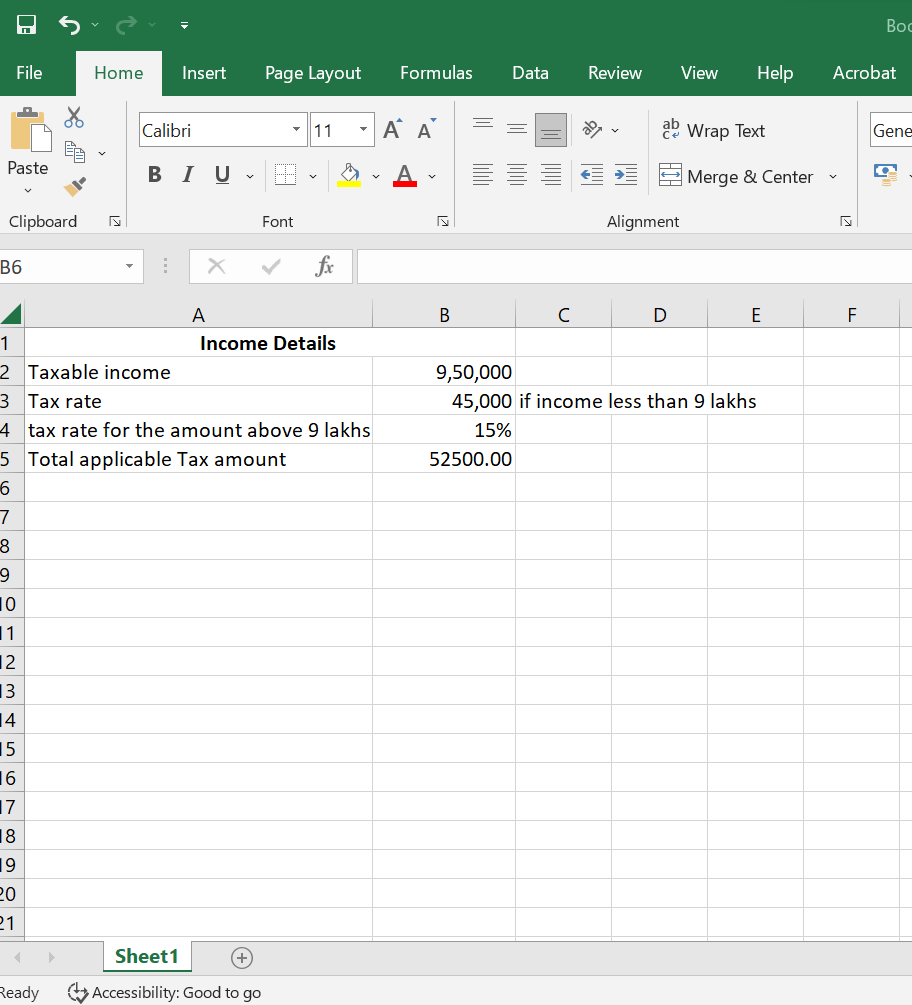

Or maybe for Rs 9 lakh 50 thousand amount, the tax applicable is Rs 45,000 + 15% on income more than Rs 9,00,000. So, here see the calculations with all the amount changed. Formula applicable will be =IF(B2>900000, (B2-900000)*B4 + B3, 0)

Note: All these examples assume that the income tax slab rate for incomes less than 3 lakhs is 0%, as per the new tax regime of Budget 2023.

Conclusion

To use the formula for different tax slab structures, simply update the tax table in the separate sheet and the formula in the main spreadsheet will reflect the changes. This is just an example, and the specifics of the formula and tax table will depend on the tax slab structure you're using. To become a master in Excel formulas, you can reach out to keySkillset Excel Efficiency course. With the mouse free hacks and spaced repetition techniques, you can be a power user in no time.

%252520(4).png)

.jpg)

.jpg)

.jpg)

.jpg)

.png)